For Your Business or Organization, Not Profit

Element business accounts are crafted right here in West Virginia. We welcome all kinds of businesses and organizations, large and small, to experience our Craft Banking difference. Schedule your appointment to open your business account at Element today!

Business Account Highlights:

- Your money stays local and supports your community

- Quickbooks integration and CSV download available

- Online banking and eStatements

- Custom debit card with business logo

- All deposits insured up to $250,000 by NCUA

Business Savings

Keep your money local and in our community with a Business Savings account or Certificate of Deposit (CD) from Element.

Business Checking

Element Business Checking includes custom debit cards and access to nearly 30,000 surcharge-free ATMS.

Business Lending

We take the time to listen to your vision, your passion, and your plan for building and maintaining a bright future.

Local Support

You have questions? We have the answers. Text, call, or chat with us. We’re here for you.

Employee Benefits

If you need a friend to help make your employees’ lives better financially, join our PEEPs (Preferred Element Employer Partners).

We’ve Got Your Back

We’ve got your back with text alerts and a mobile app that lets you control features of your Element account.

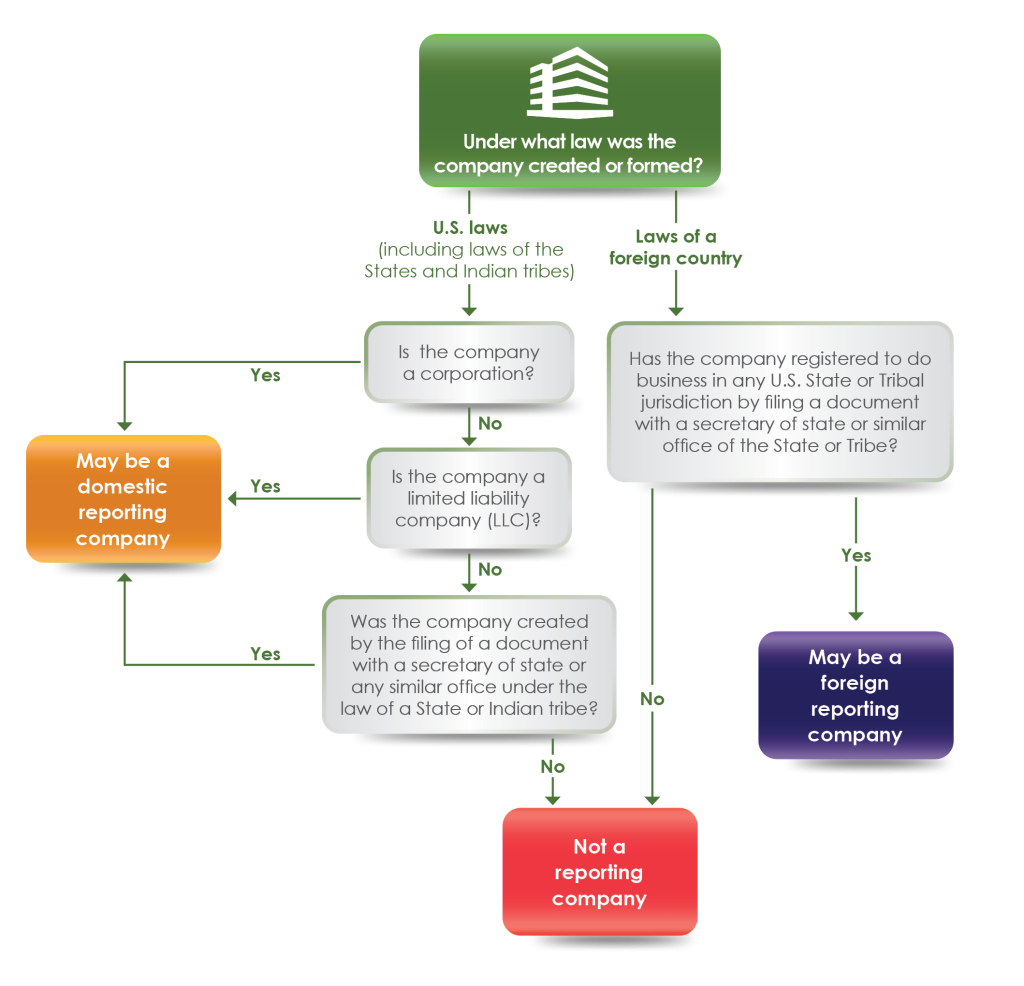

WHO HAS ACCESS TO THE BENEFICIAL OWNER INFORMATION?

FinCEN is developing the rules that will govern access to and handling of beneficial ownership information.

Currently these entities will have access:

- – Federal Officials

- – State & Local Officials

- – Tribal Officials

- – Financial Institutions

Certain foreign officials who submit a request through a U.S. Federal government agency, to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement.

HOW WILL BENEFICIAL OWNER INFORMATION BE STORED?

Non-public database using rigorous information security methods and controls typically used in the Federal government to protect non-classified yet sensitive information systems at the highest security level.

FinCEN will work closely with those authorized to access beneficial ownership information to ensure that they understand their roles and responsibilities to ensure that the reported information is used only for authorized purposes and handled in a way that protects its security and confidentiality.

HOW WILL I REPORT MY COMPANY’S BENEFICIAL OWNERSHIP INFORMATION?

If you are required to report your company’s beneficial ownership information to FinCEN, you will do so electronically through a secure filing system available via FinCEN’s BOI E-Filing website (https://boiefiling.fincen.gov).

WILL THERE BE A FEE FOR SUBMITTING A BENEFICIAL OWNERSHIP INFORMATION TO FinCEN?

No. There is no fee for submitting your beneficial ownership information report to FinCEN.

IS THERE A PENALTY FOR FAILING TO SUBMIT YOUR BENEFICIAL OWNERSHIP INFORAMTION?

A person who willfully violates the Beneficial Ownership Information reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues. That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000.

ADDITIONAL INFORMATION

FinCEN has prepared an extensive list of Frequently Asked Questions (FAQs) in response to inquiries received relating to the Beneficial Ownership Information Reporting Rule and Beneficial Ownership Information Access and Safeguards Rule. Visit their official site to learn more.

If you have any additional questions regarding your beneficial owner status, please refer to FinCEN’s Website or contact your tax provider for additional information. Please feel free to contact a Member Service Representative at 605-857-3489 for additional assistance.